Congress makes adjustments for individuals 65 and over, and for Social Security beneficiaries.

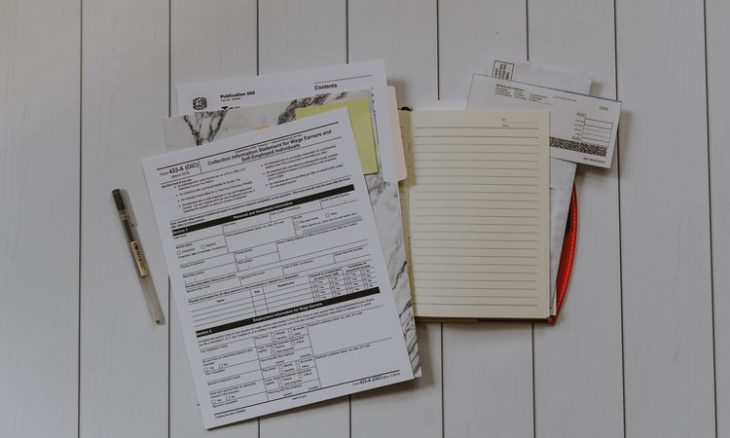

Congress enacted two laws this year, President Donald Trump’s “One Big Beautiful Bill” and the Social Security Fairness Act, which make adjustments to tax filings for senior citizens this coming tax season.

The president’s tax cut legislation introduced a deduction for taxpayers 65 and over, to be implemented for tax years from 2025 through 2028. This senior deduction will be $6,000 per eligible individual, a total of $12,000 for joint filers. The deduction is phased out for individual taxpayers with $75,000 in modified adjusted gross income, or a total of $150,000 for joint filers.

The Social Security Fairness Act repealed a number of Social Security reductions for those who receive additional benefits, such as a pension. Social security benefit statements, SSA-1099 or SSA-1042S forms, will be mailed to applicable individuals as usual.

As the Lord Leads, Pray with Us…

- For President Trump to seek God’s wisdom as he heads the Executive Branch of the federal government.

- For Treasury Secretary Bessent and IRS officials as the upcoming tax season approaches.

Sources: Internal Revenue Service, MSN, CNBC